If you want to be a Planner and not a Rusher, please go to www.paytaxeslater.com/ss and sign up to receive your free digital copy of The Little Black Book of Social Security Secrets on the day it comes out.

Eligible married couples must act by April 29, 2016 to take advantage of the two strategies that will allow them to maximize their income from Social Security.

Why?

Because a certain provision buried in the fine print of the Bipartisan Budget Act of 2015 eliminates the two strategies: Apply and Suspend and Restricted Applications for Benefits.

If you are married and will be at least 66 by April 29, 2016, you should read this book to learn whether it would benefit you to apply for and suspend your benefits by the deadline.

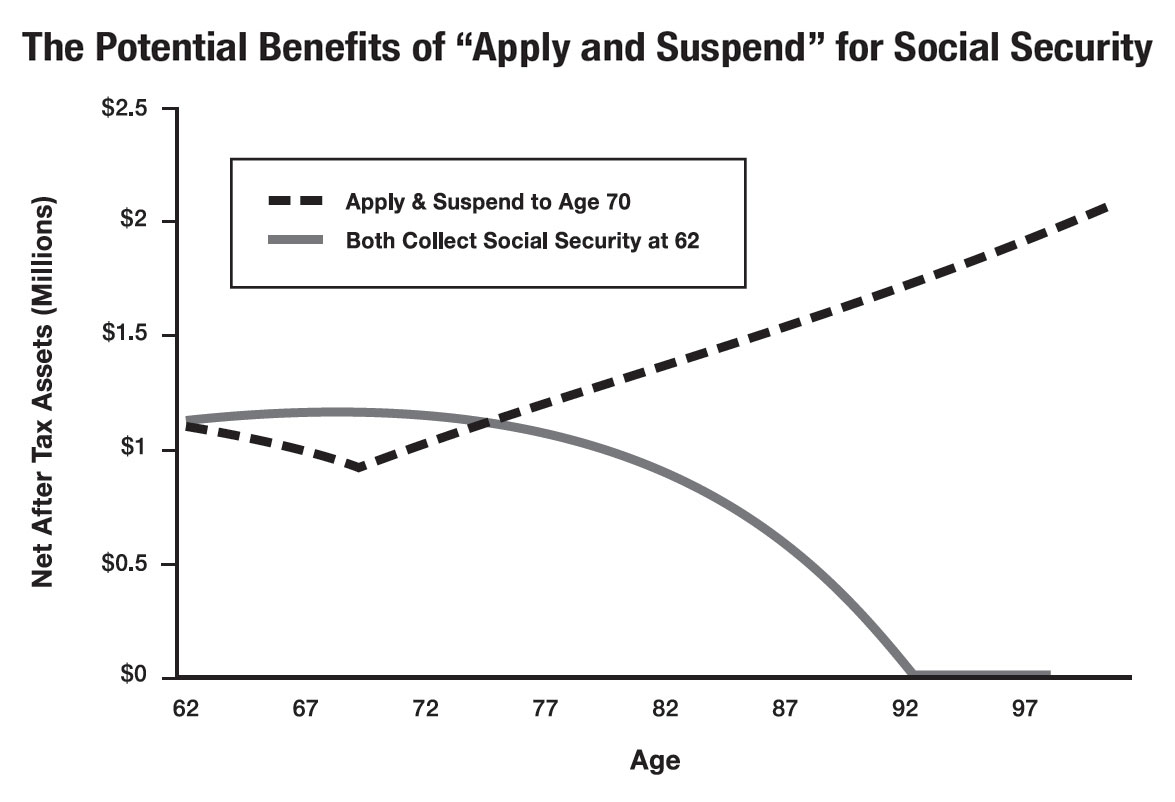

Better yet, your spouse will be eligible to apply for spousal benefits—which can be as high as 50 percent of your benefit at age 66—as soon as she is age 62. This will give your family some income from Social Security during the years that your own benefit is suspended. (If her own benefit is higher, then a different strategy should be used).

But you must Apply and Suspend by the deadline, April 29, 2016, to be grandfathered under the old rules. If you do not apply for and suspend your own benefits by April 29, 2016, your spouse will not be allowed to collect a spousal benefit unless you are also collecting your own benefit.

The second strategy, called a Restricted Application for Benefits, allows you to file for benefits and specify that you only want to receive whatever spousal benefit to which you might be entitled. Depending on your age, it could mean a monthly check as high as 50 percent of your spouse’s benefit, while your own benefit continues to grow by 8 percent, plus cost of living adjustments, every year. When you turn 70, you can then switch to your own benefit if it is higher than your spousal benefit.

If you were at least 62 years old as of December 31, 2015, you will be able to file a Restricted Application for Benefits. In order to file a restricted application, you must wait until your Full Retirement Age – which is 66 for those who will be able to take advantage of the strategy before it is eliminated.

Clearly, maximizing Social Security benefits is to your advantage. What many people do not realize is just how important it can be to the surviving spouse. If you are the higher earner and you make the right choices, your spouse will be eligible to receive a survivor’s benefit which, at maximum, will be as high as your own benefit amount. But, two of the strategies that you can use to maximize your benefits are being eliminated.

Don’t delay. Go to www.paytaxeslater.com/ss to get your free digital copy of The Little Black Book of Social Security Secrets, and then talk to a professional about your options before it’s too late.